23+ deduct mortgage points

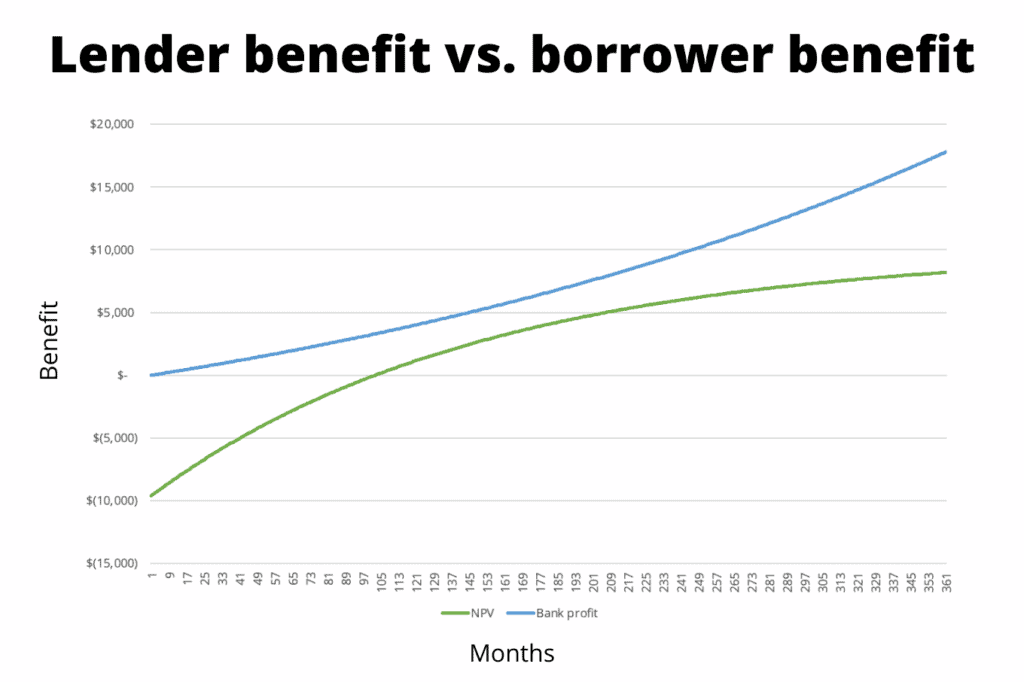

In effect youre paying more money to the lender upfront to reduce your mortgage costs over the. Homeowners who are married but filing.

Mortgage Points Deduction Itemized Deductions Houselogic

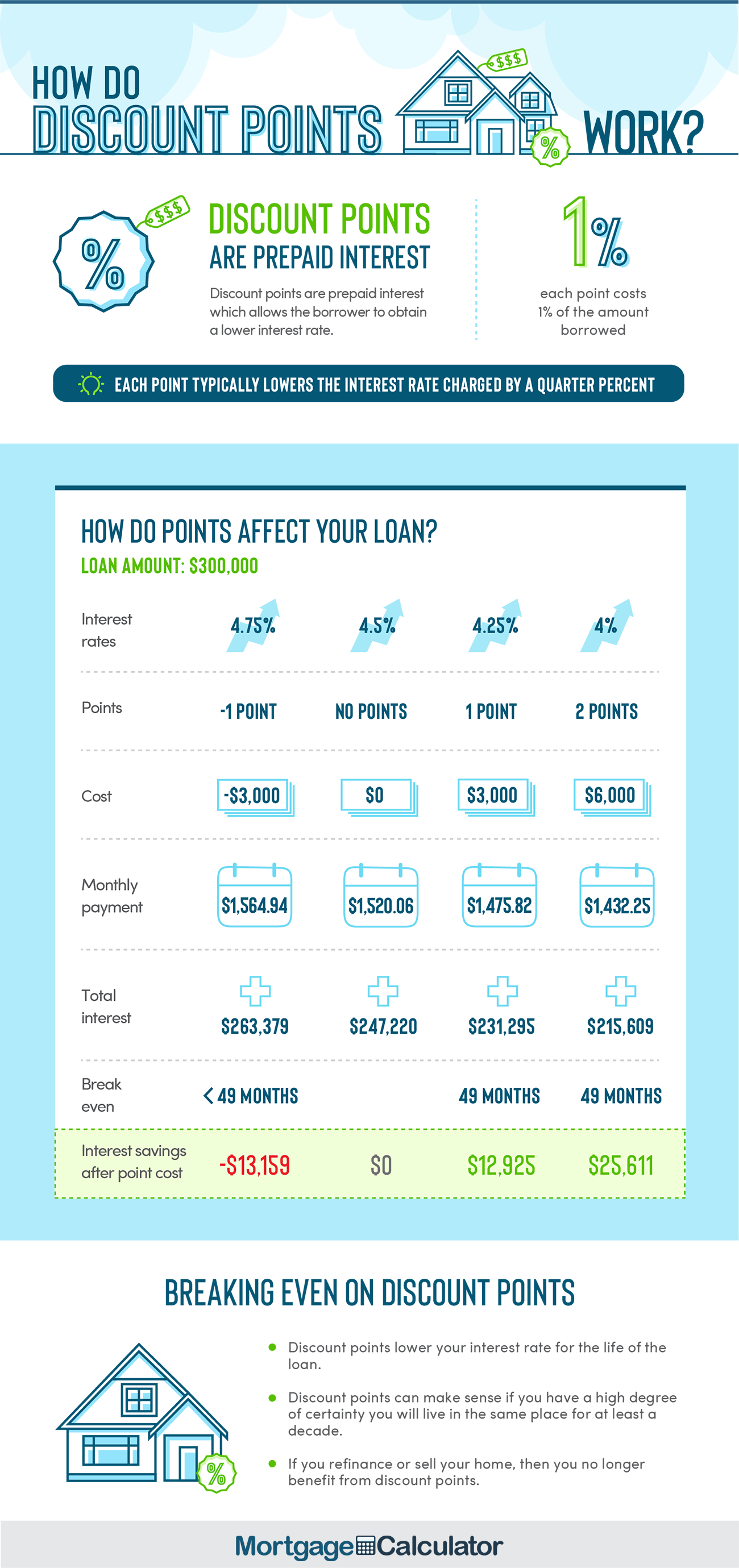

Web Discount Points.

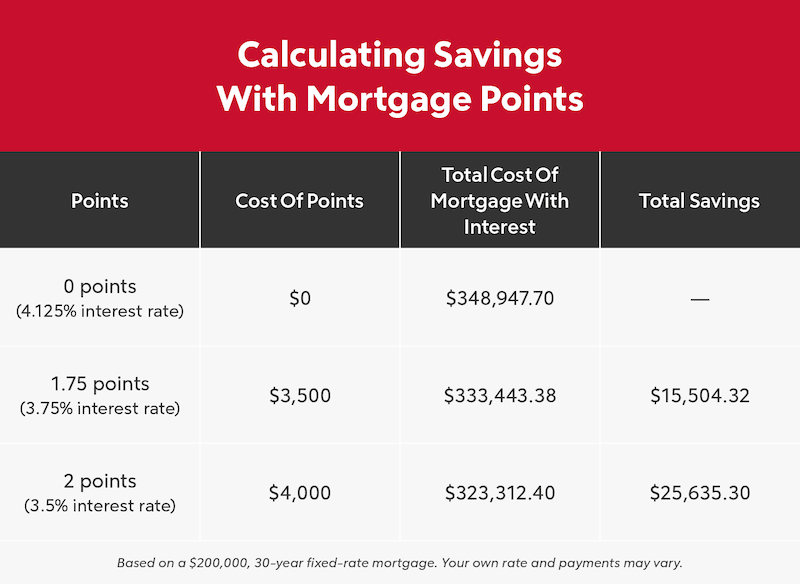

. Each point you buy typically lowers your interest rate by 025. Also called discount points mortgage points are typically paid in exchange. Usually your lender will send you Form.

Web Use Code Section Number 26 US. Web On a 100000 mortgage with an interest rate of 3 your monthly payment for principal and interest is 421 per month. Theyre discount points see the definition The mortgage is used to.

Each point is equal to one percent of the loan amount. 25100 for married filing. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web Qualifying for a deduction Generally the Internal Revenue Service IRS allows you to deduct the full amount of your points in the year you pay them. Ad Shortening your term could save you money over the life of your loan. Ad Compare the Best Home Loans for February 2023.

Web Most mortgage lenders cap the number of points you can buy. 18800 for heads of households. Generally points can be purchased in increments down to eighths of a percent or 0125.

Discount points are fees you may pay upfront to lower the interest rate on a mortgage loan. 12550 for single and married filing separately. Get Instantly Matched With Your Ideal Mortgage Lender.

Lock Your Rate Today. Code 461 - General rule for taxable year of deduction for the amortization of points. Apply Get Pre-Approved Today.

If you again refinance the loan. Web Yes you can deduct points for your main home if all of the following conditions apply. Here are the specifics.

For the 2021 tax year are. Web Mortgage points are considered an itemized deduction and are claimed on Schedule A of Form 1040. Web Using mortgage points this way is called buying down the rate.

Web Mortgage points are upfront fees calculated as a percentage of your loan amount. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Points are calculated in relation to the size of the loan with each point equal to 1 of the loan amount.

With the purchase of three discount points. However higher limitations 1 million 500000 if married. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Mortgage Points What Are They And Are They Worth It

Mortgage Points A Complete Guide Rocket Mortgage

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Should You Pay Mortgage Discount Points

Webb Weekly July 12 2017 By Webb Weekly Issuu

Should You Pay Mortgage Discount Points

What Are Mortgage Points

Calculating The Home Mortgage Interest Deduction Hmid

Cityscape A Journal Of Policy Development And Research National Survey Of Mortgage Originations

What Are Mortgage Points

Deducting Home Mortgage Points How To How Much To Deduct Pocketsense

Pdf The Public Value Of Social Housing A Longitudinal Analysis Of The Relationship Between Housing And Life Chances

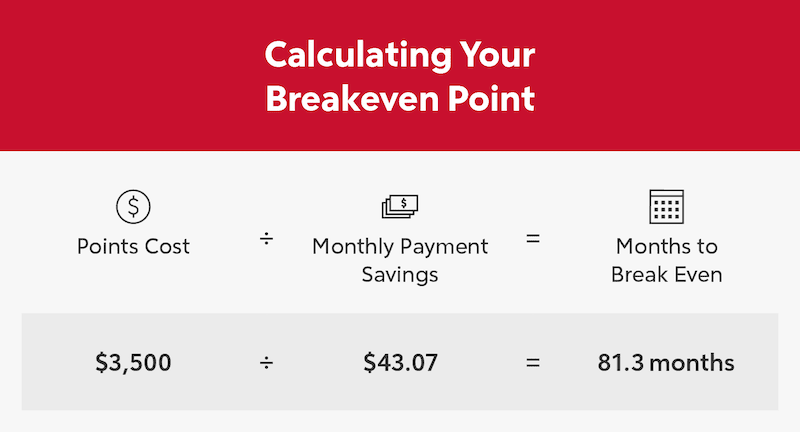

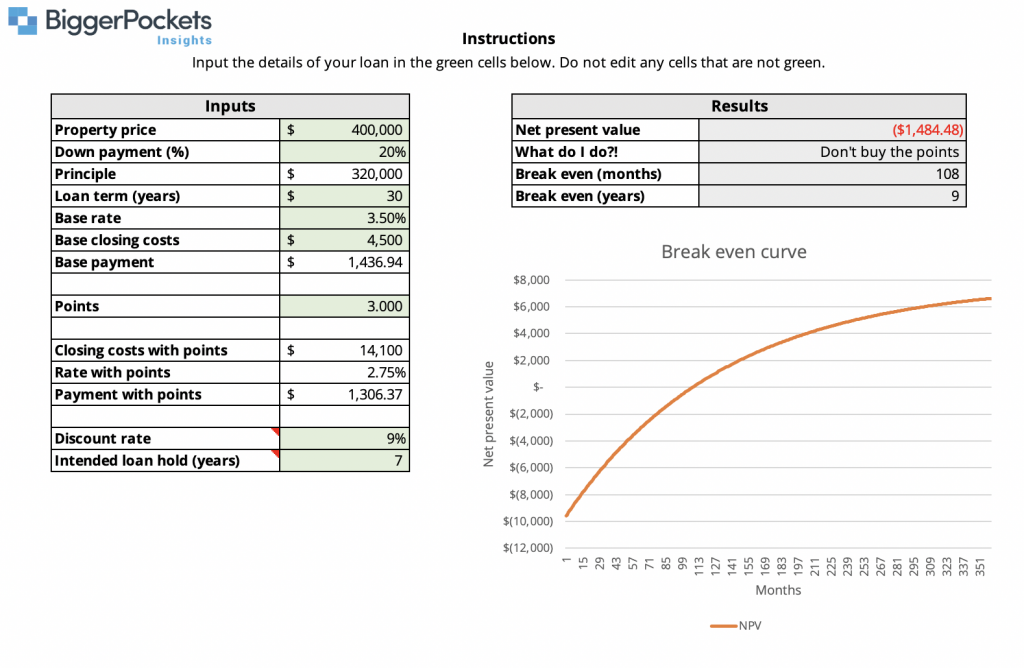

Discount Points Calculator How To Calculate Mortgage Points

Mortgage Points A Complete Guide Rocket Mortgage

Should You Pay Mortgage Discount Points

Document

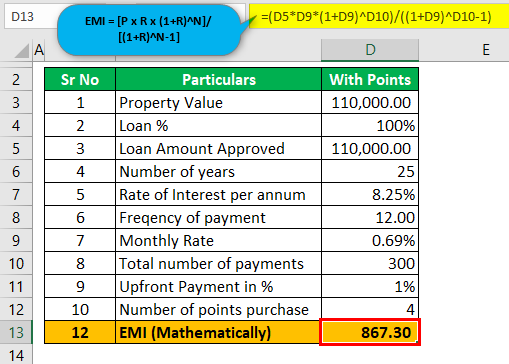

Mortgage Points Calculator Calculate Emi With Without Points